How AI is transforming investment processes and how to capture its potential without chasing trends.

In the world of investing, there’s an old saying:

“There’s more than one way to skin a cat.”

In other words, there’s more than one way to reach the same goal.

That idea perfectly captures something every investor learns sooner or later: there is no single path to achieving strong results.

There are different ways to understand the market, to read its movements, and to decide when to act.

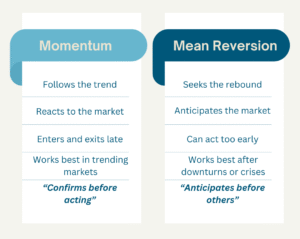

Two of the most well-known, seemingly opposite but ultimately complementary, are Momentum and Mean Reversion.

1. Momentum: Riding the Wave

The momentum approach starts from a simple idea:

| “What’s working tends to keep working.” |

Prices move because of human emotions (enthusiasm) and fear of missing out (herd behavior), creating trends that can last weeks or even months.

A momentum investor doesn’t try to guess the turning point.

They prefer to react to what the market is already showing and take advantage of that inertia.

✅Advantages: captures sustained moves, adapts quickly to new regimes, and avoids getting stuck in weak assets.

❎Drawback: usually enters and exits late, leaving some performance on the table, but in exchange, reduces false starts and timing errors.

In short, momentum favors confirmation over prediction.

2. Mean Reversion: Betting on the Bounce

At the other end of the spectrum lies mean reversion, which assumes that excesses eventually correct.

| “If something has fallen too much, it will probably recover.” |

This approach looks for opportunities in oversold assets, betting that the market has overreacted.

It performs well after crises or sharp sell-offs, when prices drift far from their fundamental values.

✅Advantages: buys low, sells high, and benefits from market overreactions.

❎Drawback: can act too early and end up “catching a falling knife,” waiting for a rebound that takes longer than expected.

In short, mean reversion favors anticipation over confirmation.

Two Styles, One Goal

Neither approach holds absolute truth.

Both aim to identify opportunities and manage risk; they do it from different angles.

You could say that:

➡️ Momentum pays a “premium for prudence.”

➡️ Mean reversion earns a “premium for courage.”

That’s why many leading quantitative managers, such as AQR, Man AHL, or Two Sigma, combine both styles. When markets trend, momentum takes the lead. When excesses unwind, value and reversion strategies step in.

Bendio’s View

Neither approach holds absolute truth.

At Bendio, we firmly believe that momentum is one of the most effective ways to capture the market’s pulse.

That’s why our core strategies are built around trend-following systems designed to identify and participate in dominant movements across different asset classes.

But we don’t adhere dogmatically to one philosophy.

Markets evolve, and true resilience comes from diversifying styles: incorporating elements of mean reversion (capturing rebounds), value (investing in undervalued assets), and carry (benefiting from yield or rate differentials) to build portfolios capable of adapting to growth phases, consolidations, and stress periods alike.

In short:

| “As Bendio, we prefer to ride the wave, but we also know when it’s time to paddle. |

Conclusion

There are many ways to navigate the market. Some prefer to anticipate; others wait for confirmation.

The key is not choosing sides but understanding how and when each approach works best.

History leaves a clear lesson:

Following this trend, with a focus on structure and risk management, it has been one of the most consistent ways to outperform the market.

And in Bendio, that remains our compass. 🧭

Source: BlackRock Investment Institute, “Megaforces – Artificial Intelligence,” November 2024. Commentary by Bendio.